Summary Beforehand

- While making smart-money conclusion today for example budgeting, setting-up an urgent situation finance and you will strengthening your borrowing from the bank will help you build a more powerful financial upcoming article-graduation.

- In time to your benefit due to the fact an early top-notch, you are into the a good set for individuals who begin planning for your later years now.

For you personally to Comprehend

Great job, grad! Since school is over, you happen to be undertaking an exciting new section laden up with alternatives and unknowns-some of which could effect your economically.

- Know where you’re economically. Your life and dealing things have in all probability changed since graduating off school, and therefore may have a massive effect on funds. Determine your budget of the subtracting your month-to-month costs from your own money. Make sure you take care to cause for people student loan money.

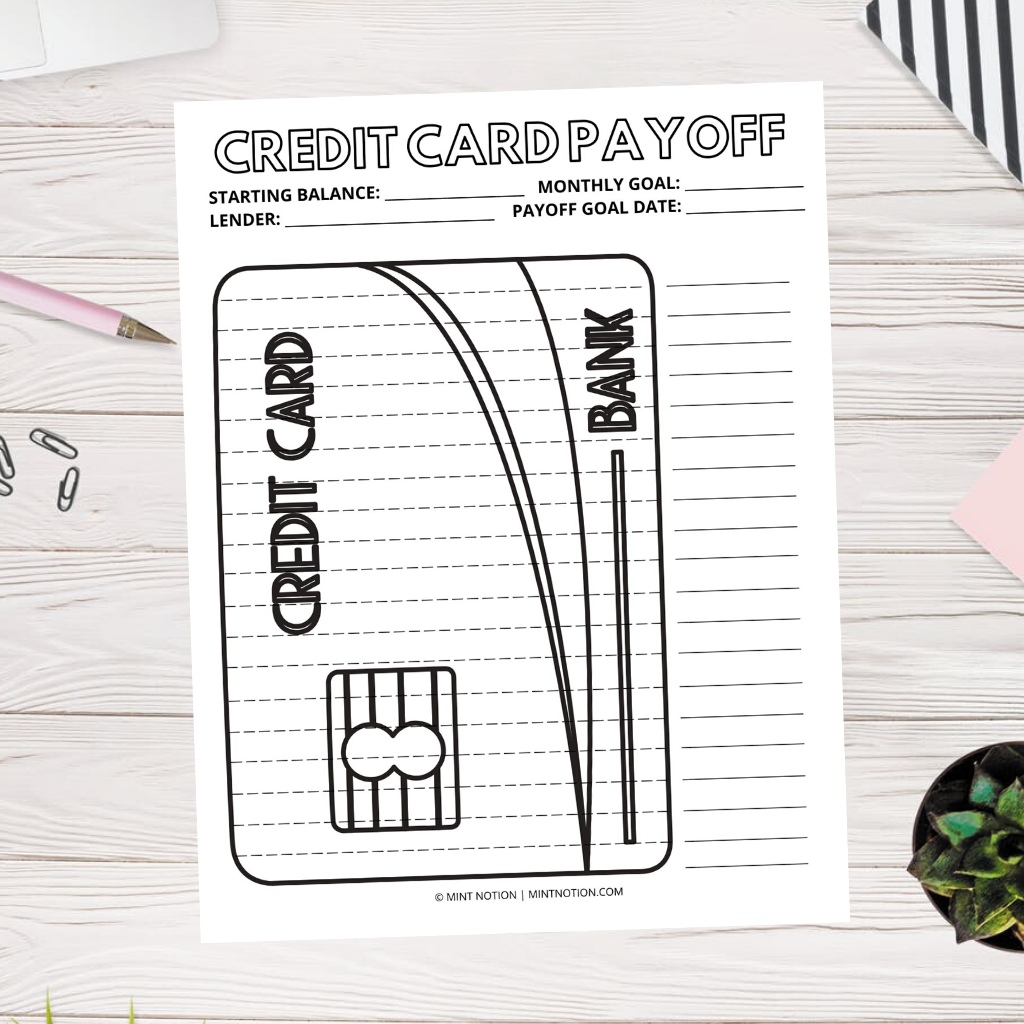

- Adhere your finances. Existence towards the finances-otherwise best, not as much as finances-can be make sure your monetary needs sit possible. Avoid way too many personal debt and construct a crisis finance in the finances. Verify that you may be being towards target from the seeing your own credit or debit card balances have a tendency to.

- Feel smart that have cost of living. Instead of blowing your financial allowance on nicest put you normally look for, think an even more well-balanced strategy. Open your mind to inexpensive groups plus don’t rule out coping with roommates, either. So you can bullet something away, limit the fresh new sales.

- Maximize staff member experts. Masters is your companion. They counterbalance insurance fees which help it can save you having old age, among other things. Into the later years top, of many businesses give matching benefits in order to an income tax-advantaged advancing years membership. If the workplace also offers that it perk, attempt to contribute to you could to earn new full suits. You could potentially boost your share a portion or even more from year to year to keep broadening their savings. It’s also possible to be provided health insurance, short- and/or enough time-name handicap insurance otherwise life insurance coverage within attractive classification cost. You are able to rescue to possess senior years yourself that have a great Traditional otherwise Roth IRA.

- Spend money on your career. When you need to house career advancement or big salary, you’ll want to continue committing to your self. System with individuals of the joining an expert company and probably creativity and you may degree occurrences. You can also just take categories to compliment your skills. Check out totally free or inexpensive programmes that could be available online or thru area degree.

- Build borrowing from the bank. That have an excellent credit rating can help you qualify for finance, handmade cards and even accommodations. You could make borrowing from the bank if you are paying expense promptly, anytime. To keep your rating good, end opening unnecessary financing otherwise borrowing from the bank accounts inside a primary period, seek to just use as much as 30 percent of overall credit limit, and you may think twice regarding closure old credit card membership, since length of your credit report could affect the get, as well.

- Explore paying higher-desire loans very first. Figuratively speaking make up the most significant sounding personal debt for most previous grads. If you also features credit card debt, it’s likely within a higher rate of interest. Lay as much as possible to the the greater-appeal debt first, while you are persisted making lowest payments toward almost every other financial obligation. This can save some costs and invite you to definitely pay off higher-attract loans faster, providing you with extra money to get into education loan debt repayment.

- Think education loan consolidation otherwise refinancing.Footnote 1 You happen to be capable stop balancing several loan payments because of the combining numerous federal fund into the one the fresh new loan. When you have a mix of personal and you can federal student loans, you could potentially re-finance all of them to one another, however you may exposure giving up special benefits associated with their federal loans. Weigh the pros and you can drawbacks before deciding. Navy Government Credit Relationship can help you refinance individual installment loans online Idaho student education loans and talk during your possibilities.

Getting your earnings in order now will assist you to reach the fresh new goals because you improvements throughout your industry and you may existence since a keen mature. A small perseverance at the start may lead to wise designs and you will larger advantages money for hard times.