There are certain things you need to simply create within the an emergency: mouth-to-mouth area resuscitation, the fresh Heimlich steer and you can cashing aside a 401(k).

Ok, atic. However, very early distributions from your retirement is really destroy your money. That’s because cashing aside an excellent 401(k) isn’t only high priced, but inaddition it affects your ability to retire.

And additionally missing out to the old-age deals and probably postponing retirement, you will likely end up owing currency into Internal revenue service and you can using an effective ten% very early delivery tax. not, the brand new punishment is quicker harsh if you are using the cash having a professional emergency.

Four aspects of cashing your 401(k)

Providing currency out of your 401(k) is truly a last lodge once the there is absolutely no way to avoid spending government (and sometimes state) taxes on the count your withdraw.

However you you’ll avoid one minute pricing-the fresh new IRS’s 10% early shipment punishment-if you use the money for example of them causes:

Difficulty expenses

If you have what the Internal revenue service calls an enthusiastic instantaneous and you will heavy financial you need, there is certainly a go you will not have to pay the new 10% early detachment payment. Qualifying reasons why you should feel the payment waived is:

- Healthcare

- Educational costs, room and board

- Eviction or foreclosure avoidance

- Funeral expenses

- Restoring harm to your residence

- Full and you may long lasting disability

Domestic get

That it detachment reason theoretically drops towards the difficulty category, but it is well worth getting in touch with aside. By using the cash to cover costs truly regarding to find a property, such as for example a deposit and you can settlement costs, the latest 401(k) very early withdrawal punishment would be waived.

Federally declared emergency

Thanks to the Safer dos.0 Operate out-of 2022, those who live-in federally declared disaster components (because the established from the Chairman) get income tax recovery on the distributions. You might withdraw as much as $22,000 instead of running into new 10% penalty.

You are over 59 ?

Once you reach the chronilogical age of 59 ?, you can start withdrawing money instead against punishment. Needless to say, you’ll nonetheless shell out income taxes into the 401(k) withdrawals, but if you dont use the called for lowest delivery, the fresh Internal revenue service can charge you a punishment from twenty-five% of the count you do not simply take.

Roll-over

The only method you could get money out of your 401(k) without any fees otherwise fees is if your perform a beneficial rollover, definition there is the currency moved right to a new retirement membership, for example an individual Advancing years Membership (IRA) otherwise a special 401(k).

These exchange can be taxable when your money was delivered straight to your as opposed to the standard bank.

Secret considerations in advance of cashing aside

The major matter you really need to respond to in advance of cashing aside good 401(k) or even providing a good 401(k) mortgage try, Simply how much will it rates? It’s likely that, this is the priciest alternative you have.

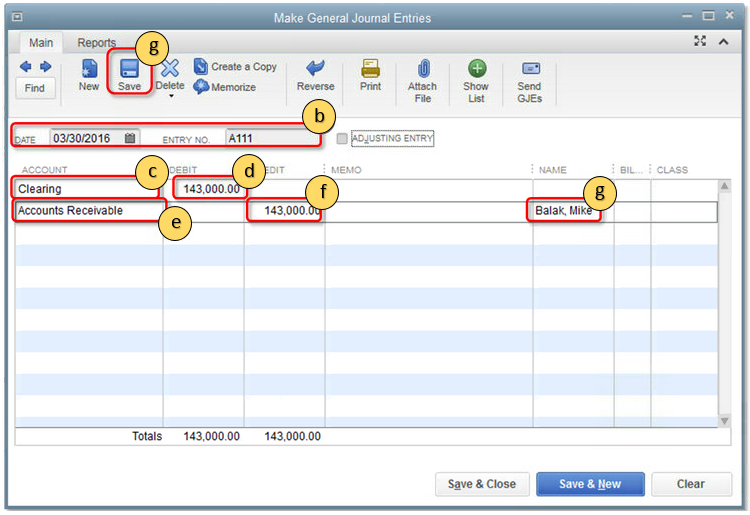

How do you calculate the price? This new Irs ount to pay for your goverment tax bill. If you cash out $ninety,000-about the common equilibrium You.S. users have inside their 401(k)s-new Irs often keep back $18,000.

If that number does not defense your complete goverment tax bill, you will need to spend the money for relax on income tax time. Otherwise, you will found a refund. Even in the event you will need to pay much more utilizes your own income and you can even when you’re in an enthusiastic Irs taxation group above 20%.

Having 2024, those who secure more $47,150 will pay a great deal more, as their taxation supports begin during the 22%. As well, you might have to figure about 10% early 401(k) withdrawal penalty.

Such as, for those who secure $sixty,000 a year, you’ll end up from the twenty two% income tax bracket. If you would like make a non-emergency withdrawal away from $twenty-five,000 out of your 401(k), is a price of just how much the fresh new withdrawal will cost:

That is a total cost of $8,000, excluding a state taxes. Once paying down those individuals expenses, you’ll have at most $17,000 leftover.

The aforementioned computation and excludes the interest it is possible to eradicate in your 401(k). Whether your 401(k) received an average come back from 6.5% a-year (including fees), good $twenty-five,000 balance manage earn more than $ten,400 for the need for five years and most $twenty five,000 from inside the 10 years.

- Later years savings: Have you got plenty of time to replace the savings ahead of old-age? Are you currently ok towards the a lot of time-identity effects of your own detachment, that’ll are put-off old-age?

- Volunteer contributions: Could you be still adding to your 401(k)? If so, stop your share and add the currency to your crisis coupons, and that means you need not spend charges for using that cash.

Advantages and disadvantages from cashing aside a great 401(k)

- Access bucks to have an urgent situation

Selection so you’re able to cashing your 401(k)

Considering just how pricey its so you’re able to cash-out your own 401(k), you can most likely select most useful possibilities. Here are a few solutions to consider:

Thought a lot of time-title

Cashing out your 401(k) is worthwhile considering if you find yourself up against a highly minimal put from circumstances. When you are during the a crisis, and it’s really often their least expensive otherwise their best way to find bucks, withdrawing the cash you can expect to offer the help you you want.