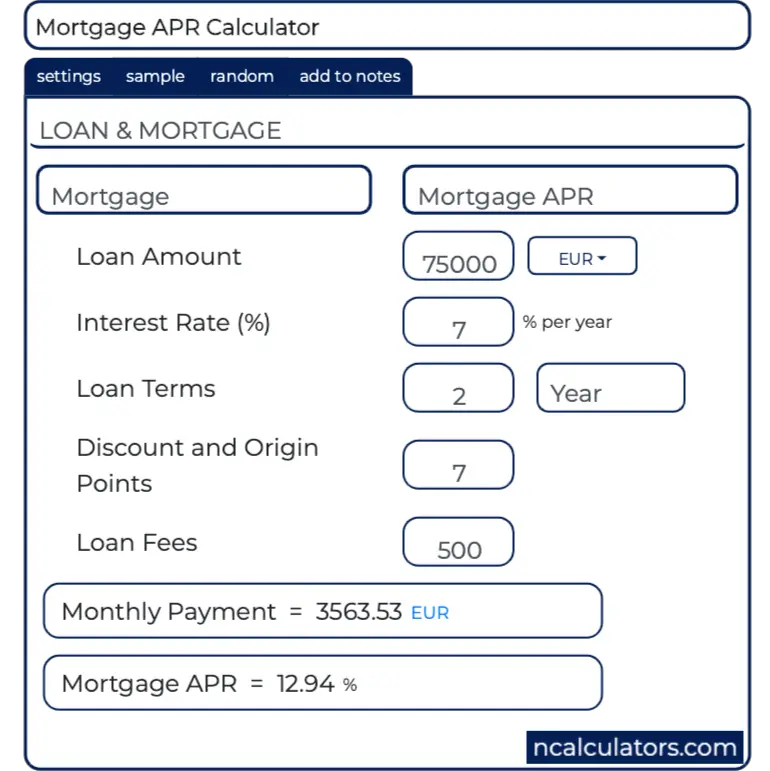

Still, mortgage focus try allowable. You should be informed of interest paid off to the financial on a beneficial 1098 means transmitted a-year inside January otherwise early February.

Things otherwise Mortgage Origination Charges Deduction

The fees and you will affairs you have to pay to acquire a mortgage is generally applied given that a beneficial deduction, considering Lisa Greene-Lewis, certified social accountant. Products may also be reported toward Function 1098 out of your bank or their settlement declaration after the season, she claims, including the guidelines for how your deduct situations vary to possess a primary get or a refinancing.

Assets Income tax Deduction

Assets tax write-offs are available for state and you will local assets taxes in line with the value of your house. Extent that’s deducted ‘s the count reduced of the assets manager, also any costs generated as a consequence of an escrow account from the settlement otherwise closing. not, the newest TCJA keeps lay an effective $ten,000 limit to your deduction.

You might find assets fees paid down on your own 1098 setting regarding you can find out more the mortgage company in the event your property taxation are paid off throughout your mortgage lender, states Greene-Lewis. If you don’t, you will want to report the amount of assets taxation you covered the year conveyed at your residence tax bill.

Home-based Opportunity Borrowing from the bank

Homeowners just who installed residential solar panels, geothermal temperatures possibilities, and you will wind turbines in 2020 and you can 2021 may discovered a taxation borrowing value doing twenty six% of your own cost. Into the , Congress enhanced this borrowing from the bank to 29% to possess installment achieved ranging from 2022-2032. There isn’t any limitation matter which may be reported.

Energy-effective window and you will temperature otherwise air-fortifying solutions can also be entitled to a tax borrowing. Take a look at IRS’s energy extra checklist to see if your be considered.

Bear in mind the essential difference between a tax deduction and you may a tax borrowing from the bank, states Greene-Lewis. “An income tax deduction minimises your taxable money, but your actual taxation reduction is based on the income tax class. A taxation borrowing are a dollar-for-money loss of the fresh new fees you borrowed from.”

It means borrowing helps you to save a whole lot more. A taxation borrowing from the bank out-of $100 create decrease your income tax duty of the $100, while you are an income tax deduction off $100 would decrease your taxation from the $twenty five when you are on twenty five% taxation class, states Greene-Lewis.

Frequently asked questions

The most effective taxation crack to possess homeowners ‘s the financial attention deduction limitation as high as $750,000. The quality deduction for folks was $twelve,950 within the 2022 and maried people submitting jointly its $25,900 (rising so you’re able to $thirteen,850 and you can $twenty-seven,700, respectively, in 2023). There are more income tax getaways that a person can allege depending on information on the home getting purchased therefore the individual.

Do you know the Very first-Go out Homebuyer Apps?

Several of the most preferred basic-date homebuyer applications are FHA loans, USDA fund, Va financing, Federal national mortgage association or Freddie Mac software, the brand new Native Western Head Financing, and effort-Effective Mortgages.

What is the First-Date Homebuyer Work?

The first-Go out Homebuyer Work is a costs recommended under President Joe Biden to minimize a person’s goverment tax bill of the $fifteen,000 to possess american singles and $7,five hundred to have married some body processing on their own. The bill is still waiting to become recognized is produced with the rules.

The bottom line

Homeownership will set you back offer past down repayments and monthly home loan repayments. Make sure to envision simply how much home you can manage prior to starting to see-just towards the household, but also for a home loan company.

Definitely cause of closing costs, moving costs, your house inspection, escrow costs, homeowners insurance, assets taxes, costs off fixes and you will repairs, possible homeowner’s organization charges, and much more,” states J.D. Crowe, president out-of Southeast Financial as well as the former chairman of Home loan Lenders Connection out of Georgia.